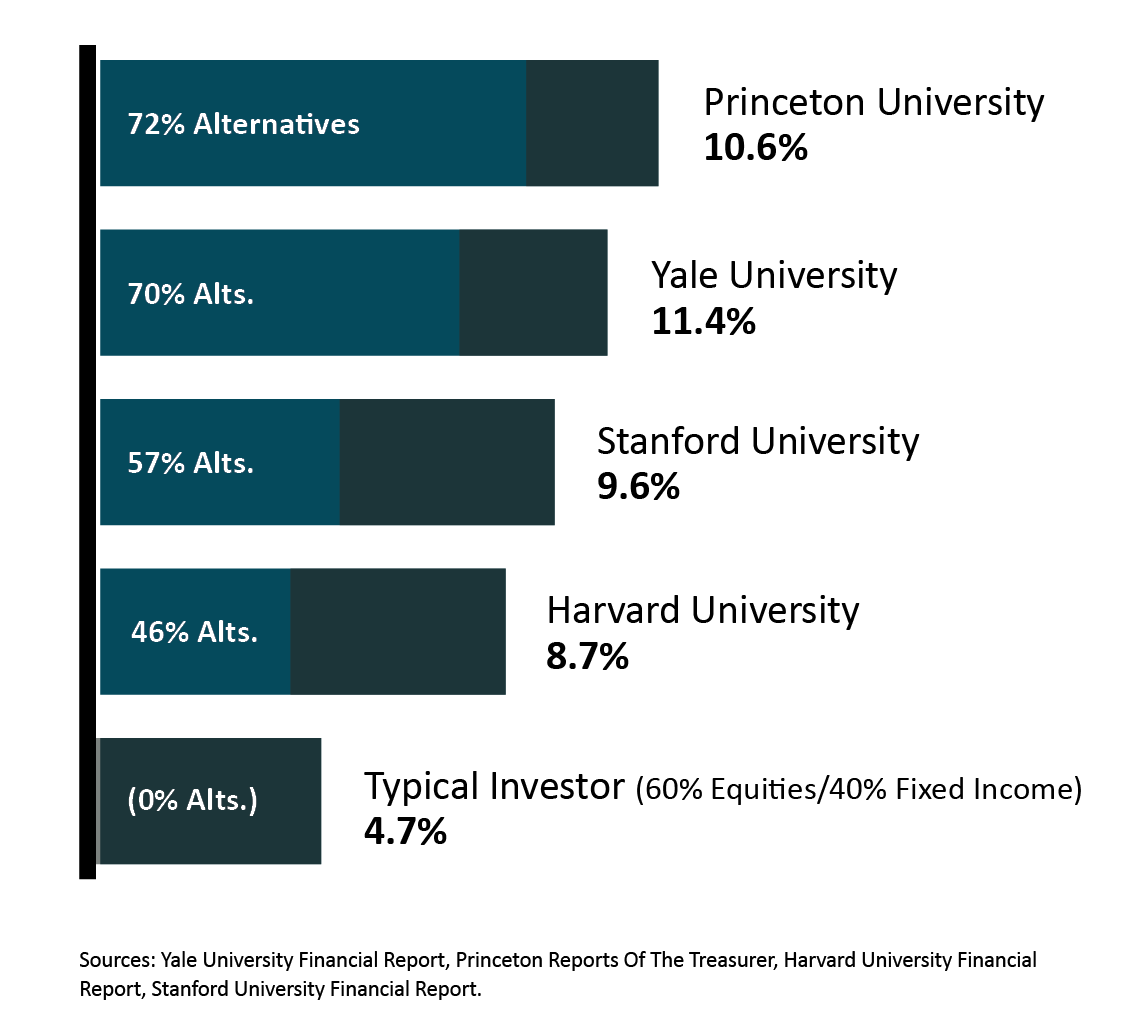

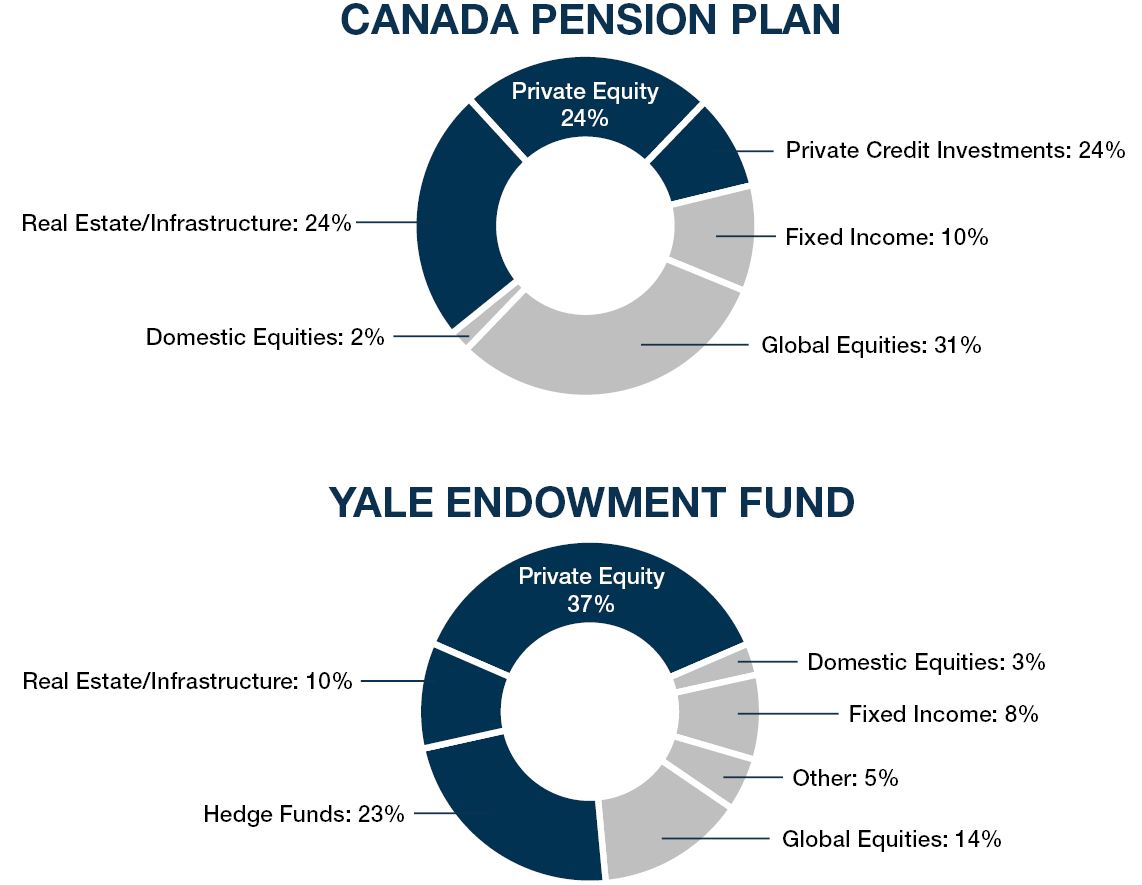

The most sophisticated investors in the world are allocating more of their assets to Alternative Investments due to chronically low bond yields, extreme central bank intervention, and the threat of overheated stock valuations. They believe that Alternative Investments will give them a better chance of achieving sufficiently higher returns to meet future obligations while protecting against excessive downside risk.

Goodbye Traditional 60%/40% Portfolio – High-interest rates during the 80’s and 90’s supported the case of the “balanced” portfolio. Today, volatile equity markets coupled with increasing interest rates and low return bonds have created headwinds for the investment community.

Barrons, JP Morgan, and Bank of America all say your traditional 60/40 retirement portfolio is dead. In fact, JP Morgan says your 60% equity and 40% fixed income portfolio will only be expected to generate 3.2% annually going forward. For the majority of Canadians, 3.2% after inflation and taxes simply will not work!

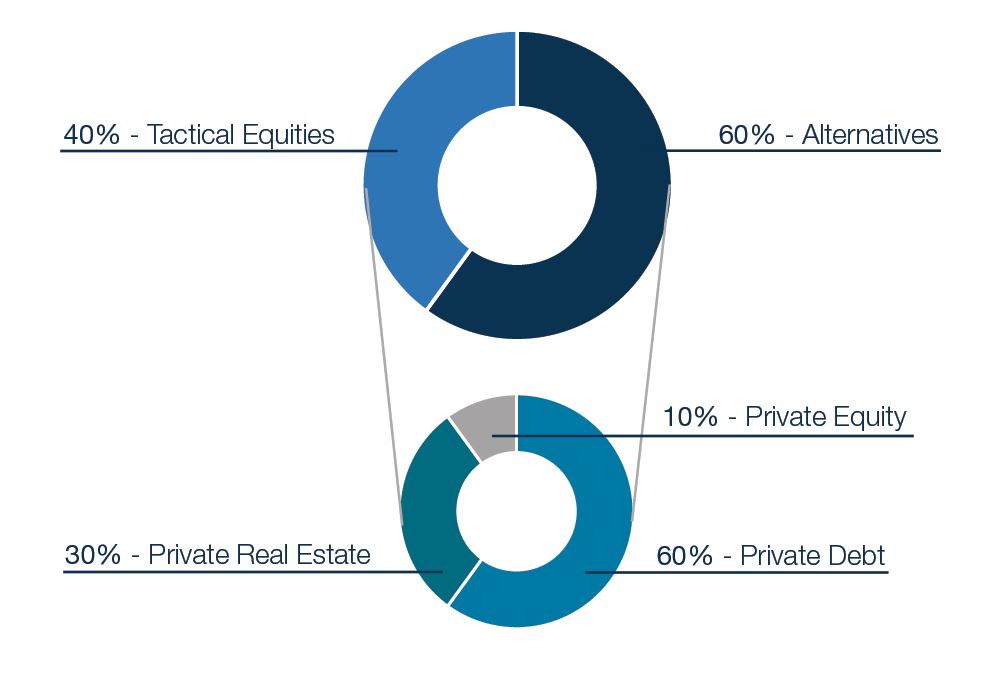

Hello New Pension Fund Style 60% / 40% Portfolio – At Harbourfront, we believe an asset mix (as shown here) 40% Tactical Equities, 60% Alternatives.

Diversification – Different asset classes with different investment/risk profiles results in lower risk when combined in a portfolio.

Low Correlation – With the recent invention of ETF’s, we’ve seen a big uptick in Fixed Income & Equity correlation, alternatives have low to zero correlation with equity markets and traditional fixed income options, creating a more efficient portfolio.

Reduced Drawdowns – Uncorrelated assets will perform differently at different times. Alternatives historically perform more than stocks and bonds with lower volatility, protecting portfolios from large drawdowns or losses.

Risk-Adjusted Returns – With lower volatility than fixed income and equity, but high-income streams, alternatives can provide risk-adjusted returns.

Investor Satisfaction – Lower volatility, reduced drawdowns, and more consistent income streams create a happier, more satisfied client.

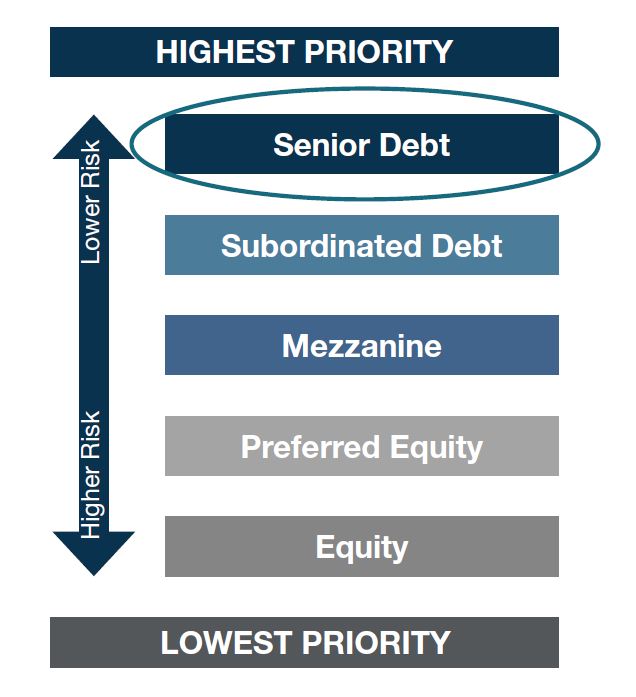

Private credit, also referred to as privately negotiated loans outside of the tier-one financial system, provides investors with senior secured loan positions, making private lending an attractive option for portfolio diversification. Private credit provides equity-like returns, typically without the volatility which exists in the stock and bond market.

Who Invests in Private Credit? – Private Lending has been broadly adopted by Institutional investors within Canada. Canada Pension Plan Investment Board (“CPPIB”), Public Sector Pension (“PSP”), and Ontario Teacher’s Pension Plan (“Ontario Teacher’s”) to name a few, have all increased contributions to private credit within their portfolios. Since 2005, the nation’s biggest pension manager CPPIB has increased its private credit allocation from $0–$20.4B as of 2018 (CPP Investment Board, 2018 Breakdown of the Investor Base of Private Lending by Type, source: Preqin Private Debt Online 2018 Annual Report). Other Canadian investment goliaths like the PSP and Ontario Teacher’s followed suit, with PSP increasing its private credit allocation by 15% between March 2018–2019 (Public Sector Pension Investment Board, 2019 Annual Report) and Ontario Teacher’s by almost 5% from 2017–2018 (Ontario Teacher’s Pension Plan, 2018 Annual Report).

Disclaimer: Bond rating may not be available.

With many funds offering investors different risk/reward profiles that broadly look attractive relative to traditional fixed income options, private lending funds have increasingly made their mark on institutional and retail portfolios alike. Private lending is an increasingly attractive option for portfolio diversification and varying return potential.

*Private credit entails various risks and illiquidity characteristics not present in public assets and traditional fixed income, and is not suitable for all investors. Speak to your advisor to determine if an allocation to private credit is suitable for you.

For over 20 years, Private Equity investments have outperformed their counterparts in the public market. This is largely due to their ability to better weather turbulent markets and economic downturns. In fact, recessionary environments have acted as catalysts for growth in the private equity landscape due in part to opportunities created. Today, the COVID-19 pandemic has created a capital vacuum providing investment opportunity in this space that hasn’t been seen in over a decade.

The superior performance of private equity investments can also be attributed to an increase in companies choosing to wait longer before going public, ultimately coming to market fully valued. Whether private businesses are grappling with the demands of their growing enterprise or looking to solidify their legacy for the future, the need for investment capital is abundant. As a result, Private Equity has grown to become the single largest Alternative Asset Class globally.

With Private Equity yielding superior investment returns, often with significantly reduced volatility, it is no wonder that institutional investors have been continuously increasing their exposure to this asset class in their portfolios.

*Private equity has various risks and illiquidity characteristics not present in comparable public equity investments, and may not be suitable for all investors. Speak to your advisor to determine if an allocation to private equity is suitable for you.

DISCLAIMER: Always talk to a professional before investing to know if the product is right for you. Past performance does not necessarily predict future results, each asset class has its own risks.

Strategic Private Wealth Counsel. Embodying a philosophy of independent, unbiased advice with an unwavering commitment to delivering true wealth management.

© 2025. Copyright by Strategic Private Wealth Counsel of Harbourfront Wealth Management Inc. All Rights Reserved. No portion of this site may be replicated without permission.